Despite a strong start, sales of heat pumps have shrunk over the course of 2023, new data from the European Heat Pump Association (EHPA) shows.

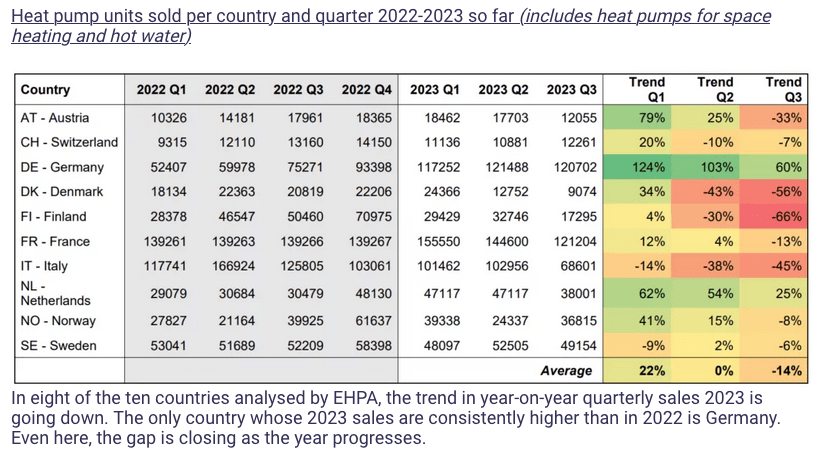

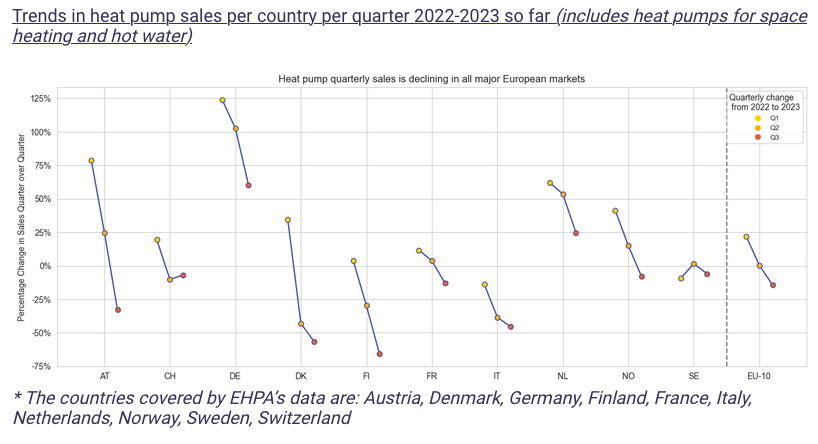

After a good first quarter, second and third quarter sales of space and hot water heat pumps are down in Europe. In many countries, sales are also lower than in the same quarter of 2022. On average in the ten countries analysed, the third quarter 2023 sees a sales decline of 14% compared to 2022 (see table below)*.

This drop is part of an alarming trend that puts reaching Europe’s decarbonisation targets at risk. It also jeopardises the €7 billion of investments announced by heat pump and component manufacturers for the building and renovating of production facilities from 2022 to 2025. These investment plans were a reaction to positive policy recognition of the technology and booming demand in 2022 and before.

The declining sales can be linked to ambiguous communication from policy-makers as well as changing government policies and subsidies, which have thrown consumers into uncertainty. The drop is also due to fossil gas prices falling, while the price of electricity – which is used by most heat pumps – remains unchanged, making heat pumps less financially attractive to operate.

These points must be addressed in the European Commission’s upcoming heat pump action plan – due to be published in early 2024.

National governments should likewise propose solutions to these issues in their national energy and climate plans and work in particular on making energy taxation more balanced, phasing out fossil subsidies and reducing the burden of electricity from taxes and levies.

Thomas Nowak, secretary general of EHPA said:

“Heat pumps are the most cost-efficient, climate-neutral way of heating and cooling, yet consumers see them as expensive and an uncertain bet. Policy-makers need to correct this by committing unambiguously to heat pump technologies and by establishing favourable economic conditions for the cleanest heating solution available. As an immediate measure, policy must aim at reducing the cost of electricity for residential, commercial and industrial applications. It should not be more than twice the price of fossil gas.”

External link

Present gas users have relaxed and stayed with gas when gas prices went back to normal while heat pump makers and installer have raised prices because of the huge demand. Now the sector must come back to normal prices, and probably even lower equipment costs, which should be possible in the large market that is manitained. Also maintained fossil subsidies, electricity taxes without similar taxes in gas, stop-go effects of subsidies are issue for the market in several countries, see the Coolproducts report: https://www.coolproducts.eu/heating-and-cooling/diverting-half-of-fossil-boiler-subsidies-to-heat-pumps-can-decarbonise-heating-by-2040-new-report-finds/

Thanks so much for this comment, Gunnar. Well explained. Thanks for link to Coolproducts report.

extract from the article “It (electricity) should not be more than twice the price of fossil gas” – erm… given marginal pricing, given that CCGTs are roughly 50% effcienct (= elec from a CCGT is x2 the price of gas + ETS on top) then perhaps Mr Novak would care to lobby the European Commission & the Council for a 2nd electricity market reform. Cos short of that, gas will remain much cheaper than elec and HPs will contiune ot look to be very expensive. (& note that even with renewables @ Euro50/MWh – this is still a bit above gas).

Thanks Mike. Good point.