Mark Shahinian, Vice President, Alpha Development, at Gridium writes on the utility dive website about his views why there has been slow growth of energy efficiency in the commercial building sector.

Setting free the dancing bear: A practitioner’s view of how to break open energy efficiency

Energy efficiency is the dancing bear of the electricity world — a sector that we’ve trained to react to subsidies and incentives in a way that amuses the circus-going public, but that acts out a poor simulacrum of its true potential.

In our experience working with commercial building owners and operators, the frustratingly slow growth of energy efficiency is due to four important market failures that drive up transaction costs: split incentives, frequent building sales, counterparty risk and savings quantification. If properly unshackled from the market failures holding it back, energy efficiency could become a roaring, powerful force in the energy landscape.

The subsidy illusion

The electric power industry has lit billions of dollars on fire to fund programs constructed on a fundamental misconception about the economics of energy efficiency. Regulators, academics and industry consultants are focused on subsidizing energy efficiency programs and on the cost of such subsidies.

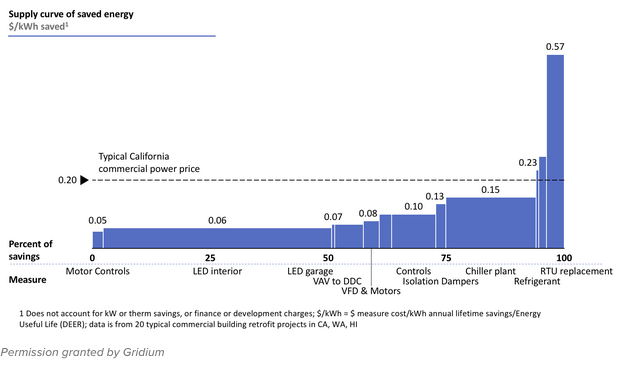

But subsidies are not solving the actual problem. The chart below shows the non-subsidized supply curve of energy efficiency that we’ve seen in some of our projects in California, Washington and Hawaii this year:

Note that most of the savings are priced below the price of electricity — with a raw savings potential of $0.14 per kWh in the case of LED lighting retrofits. Of course, the main benefit for a building owner of reduced electricity consumption is reduced operating costs, which translate to a higher asset value for their building.

Yet even with the large benefit building operators would gain from implementing energy efficiency, programs are struggling to meet their goals around scale and cost effectiveness. Regulators are right to scrutinize decreasing program effectiveness, but are wrong to increase subsidies or resort to codes and standards as the main fallback. In reality, regulators are missing the biggest obstacle to a robust energy efficiency market.

Transaction costs are the real issue

That obstacle is high transaction costs. In a market like energy efficiency, where our customers see potential project financial returns of 15 to 20% per year, you would expect to see incredible growth. But transaction costs are choking that growth.

Transaction costs are structural issues that make it expensive for parties to buy or sell goods or services in a market. The main drivers of transaction costs in energy efficiency are:

- Split incentives between landlord and tenants

- Frequent building sales

- Counterparty risk

- Savings quantification

These costs are binary in nature and involve long-term hard-to quantify risks with few good private mechanisms to address them. We find they do not go away for larger projects. For example, counterparty risk scales with the size of the project, and so is not addressed by simply taking on larger projects.

We also find that regulators tend to underestimate the extraordinary risk-aversion of both the project finance groups in banks that fund energy efficiency projects and of the real estate firms that own and operate large commercial buildings.

What can regulators do?

Regulators should focus first on removing the drivers of transaction costs that are throttling the widespread implementation of efficiency measures. In our experience working with commercial real estate operators, most projects are faced with several of the issues listed below.

Let’s go a little more in depth on each of them:

Split incentives

In most privately-owned buildings, landlords own the building but tenants pay the greatest part of energy-related charges — typically in a pass-through arrangement managed by the building owner. Neither owners nor tenants have the proper incentives to lower the energy use of the building.

In our discussions with customers, split incentives are a hard barrier to efficiency projects. The complexity of contracting around risk mitigation, agency issues, equipment ownership and liability is extremely costly to overcome.

The way through this problem is for regulators to create programs where utilities bill customers for savings. When the party that pays the bill pays for the savings, the incentives are unified, so long as bill neutrality and appropriateness checks (e.g. no marble lobby upgrades) are in place to protect the bill-paying party. The transaction costs that would otherwise have to be worked out between the landlord and tenant disappear.

Unfortunately, most on-bill finance programs require too short a payback (five years or less) and are too poorly capitalized (with maximum project sizes usually $250,000 or less) to enable our customers to do the deep energy retrofits that would lower their large buildings’ energy consumption by 25% or more.

Frequent building sales

Commercial buildings in active real estate markets — i.e., any major metro area — are typically sold every three to five years. The cost this imposes is similar conceptually to that of split incentives. One group, current owners, makes an investment and another group, future owners, largely benefits from that investment if current owners sell the building within a few years but the investment pays back over a long period of time.

This has a limiting effect on the class of efficiency measures that can be deployed. Lighting retrofits are typically the only extensive measures that pay back in less than three to five years.

Passing on financing-encumbered building improvements to new owners at building sale is usually costly to the seller. Regulators can approve of structures that ensure the efficiency project transfers easily with the building at sale. When these transactions are automatic, costs are dramatically lowered.

Counterparty risk

Commercial buildings are rarely credit-worthy entities in and of themselves. They do not issue rated debt, for example. They are often limited liability corporations designed to shield their owners in the case of a bankruptcy. That shield means that would-be project funders — banks and investment funds — are loathe to fund projects for which there is diminished protection for financiers in the event of a building bankruptcy.

The transaction cost arising from counterparty risk takes the form of high borrowing costs. Banks demand compensation in the form of higher interest rates, fees, and required reserves for lending to such counterparties.

Payment of utility bills, on the other hand, is a very low risk proposition and is well understood in the marketplace. In banking parlance, the “default rate” for non-payment of utility bills is vanishingly low. Consequently, counterparty risk is straightforward to address.

Presenting payment for electrical energy alongside payment for efficiency savings on the same monthly utility bill has a calming effect on prospective lenders and can be expense-neutral to owners and tenants while providing the mechanism for capital recovery. With the utility collecting and disbursing customer payments, the risk — and associated transaction cost — is dramatically reduced.

Savings quantification

If savings are measured, they can be financed and a market can grow around those measured savings. The innovations in software and data availability over the past decade have allowed for very sophisticated measurement in a way that was not previously possible.

Regulators can act as a “weights and measures” inspector, assuring market actors of the accuracy of savings calculations. The power of an independent, sanctioned measure is that it enables transactions, often with third party capital set up to take and manage the risk of project performance.

Regulators know how powerful the Power Purchase Agreement model has been in bringing private capital to bear on distributed energy development. We know the same potential exists in energy efficiency, with billions in capital ready to deploy once market mechanisms are in place.

Setting free the dancing bear

Market mechanisms for energy efficiency are much less developed than those for other energy resources. This is particularly true in the underserved commercial real estate sector.

Our customers and banking partners regularly turn down projects with 15 to 20% internal rates of return — well above their cost of capital — if transaction costs cannot be addressed. The opportunities for regulators here are vast.

Notably, we already have a widespread model that shows how well efficiency markets work when transaction costs are reduced. These drivers of transaction costs have largely been addressed in the MUSH-oriented (Municipalities, Universities, Schools, Hospitals) ESCO (Energy Services Company) market due to the structure of that market (e.g. governments are creditworthy counterparties).

Consequently, ESCOs have been much more successful in the MUSH sector and have created an $8 billion market there — a market that addresses only about 20% of U.S. building stock.

The rules of these efficiency markets will be important. Instituting on-bill treatment for measured savings, with the ability for long payback periods to span changes in building ownership will be an enormous step forward and will encourage capital investment in efficiency projects that go deeper than changing lightbulbs.

The MEETS Coalition has been working with regulators and utilities on building out this model. Indeed, on-bill financing programs with long payback periods like Pacific Gas & Electric’s and transaction-focused efforts like Seattle City Light’s are starting to make a huge difference.

Similarly, the guidance out this year from California and PG&E on Normalized Metered Energy Consumption is a good example of regulators and utilities arriving at rules that enforce rigorous, peer-reviewed methodologies for measuring energy efficiency.

Meanwhile, other jurisdictions around the country are starting to take measured savings seriously. Down the road, time-of-day pricing for energy efficiency could make it a true grid resource.

The energy efficiency bear has been caged and mistreated. Regulators and utilities who address the market failures that drive up transaction costs will turn energy efficiency into a creature that captures deep savings with the ease that a grizzly bear catches salmon, and will see their built environment and efficiency industries transformed.

External link

A very interesting and perceptive article. But the disappointing experience in the UK ,where Green Deal repayments in the commercial sector were structured much as the author proposes, doesn’t augur well.