Larry Elliott provides a sobering article in The Guardian as he reviews BP’s latest annual global supply and demand analysis. The report shows that the 40% forecast rise in energy demand can only be met by fossil fuels.

BP: huge rise in energy demand at odds with climate change fight

Rising global demand for energy over the next two decades is at odds with the fight against climate change, the head of BP said on Tuesday, as he outlined the oil giant’s forecasts showing unsustainable increases in carbon emissions.

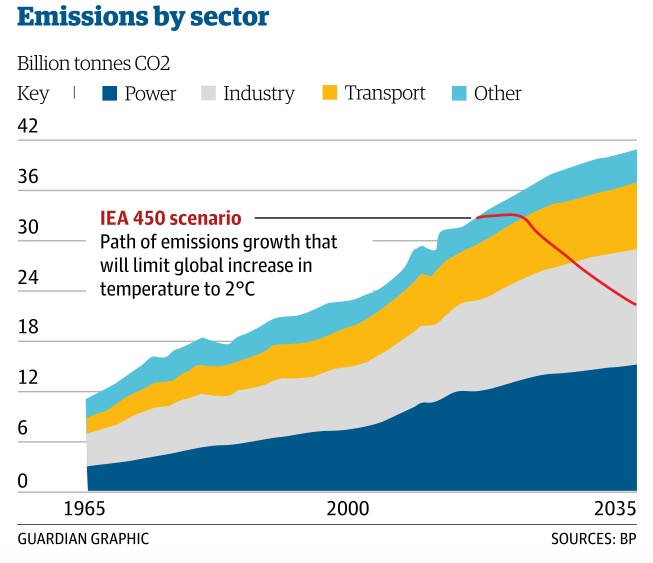

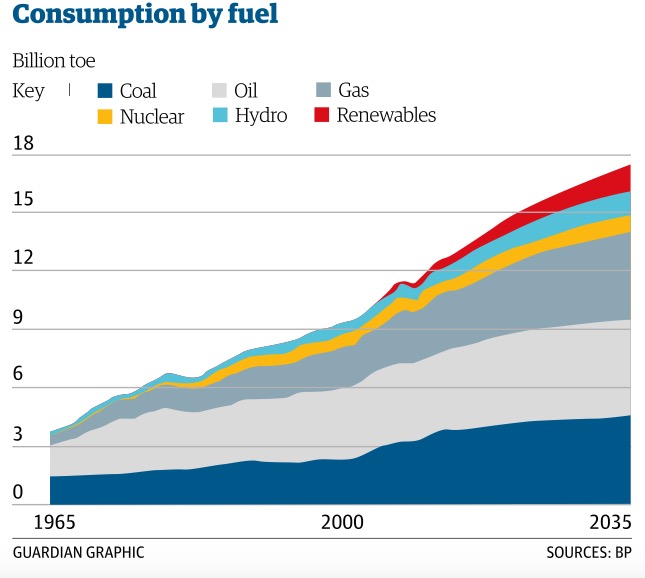

BP’s annual energy outlook predicted that the world economy would double in size in the next 20 years, resulting in demand for energy rising by almost 40%. The company said two-thirds of this demand would be met from fossil fuels – oil, gas and coal – and that this would lead to a 25% increase in carbon emissions.

BP said slower growth in China and India coupled with greater energy efficiency would mean that demand would rise by 1.5% a year over the next two decades, rather than the 2.5% a year recorded during the past decade.

Even so, the company said carbon emissions would be growing by 1% a year – “well above” the path recommended by scientists to keep emissions below the ceiling of 450 parts per million that would provide a 50% chance of stabilising global temperatures at 2% above pre-industrial levels.

Dudley added that the environmental risks put pressure on politicians to come up with a deal at this year’s climate conference in Paris. “The projections highlight the scale of the challenge facing policy makers at this year’s UN-led discussions in Paris. No single change or policy is likely to be sufficient on its own.

“And identifying in advance which changes are likely to be most effective is fraught with difficulty. This underpins the importance of policymakers taking steps that lead to a global price for carbon, which provides the right incentives for everyone to play their part.”

BP said the continued increase in emissions would come in spite of less reliance on coal over the coming decades. China has been heavily dependent on coal during its rapid industrialisation since 1990, but demand is expected to grow at 0.8% a year in the period up until 2035, down from 3.8% a year since 2000.

Even with the expected rapid growth in the use of renewable forms of energy over the next two decades, they will still only account for 8% of energy demand by 2035, BP said. Fossil fuels will account for 81% of energy, down from 86% at present.

“Fossil fuels are projected to provide the majority of the world’s energy needs, meeting two-thirds of the increase in energy demand out of 2035,” Dudley said. “However, the mix will shift. Renewables and unconventional fossil fuels will take a larger share, along with gas, which is set to be the fastest-growing fossil fuel, as well as the cleanest, meeting as much of the increase in demand as coal and oil combined.

“Meanwhile, coal is now expected to be the slowest-growing fuel, as industrialisation in emerging Asian economies slows and environmental policies around the globe tighten.”

BP believes the recent fall in oil prices will prove temporary, putting the decline from $115 a barrel to a low of $45 a barrel down to increases in supply caused by the US shale revolution. Recent weeks have seen a partial recovery in the oil price, with the cost of a barrel of Brent crude standing at around $62 a barrel last night.

The oil company said growth in supply from the new US fields would slow but that global demand would continue to increase, leading to higher prices.

The forecasts suggest that the US will be self-sufficient in energy by the 2030s, but that the fracking revolution will not spread to other parts of the world.

Spencer Dale, BP’s chief economist, said: “After three years of high and deceptively steady oil prices, the fall of recent months is a stark reminder that the norm in energy markets is one of continuous change. It is important that we look through short-term volatility to identify those longer-term trends in supply and demand that are likely to shape the energy sector over the next 20 years and so help inform the strategic choices facing the industry and policy-makers alike.”

BP anticipates a slowdown in US shale oil allowing for Middle East output to start regaining lost ground at the start of the next decade, according to the report. The 12 members of the Opec (Organisation of Petroleum Exporting Countries) cartel will expand output by 7 million barrels a day while non-Opec supply will increase by 13 million barrels by 2035. Opec will keep its market share of 40% of total global crude production by 2035, according to the report. “These reports of the demise of Opec seem to me greatly exaggerated,” Dale said. The group decided in November not to cut its production target in order to keep its market share against a backdrop of rising supplies from non-Opec nations, a move that accelerated the fall in oil prices at the end of 2014.

The company produced alternative forecasts for global energy demand based on China and India growing at 4% a year rather than the 5.5% a year expected in the base case. In those circumstances, energy demand would rise by 25% rather than 37% in the next two decades – with the difference equivalent to the total energy needs of the European Union in 2035.

Over the same period, North Sea oil production is expected to decline to around 500,000 barrels per day as fields in the basin deplete.

“The North sea is a very mature oil and gas province and it will inevitably go through a decline. It peaked in 1999 at around 2.9 millions barrels per day and our projections are that it will be half a million barrels in 2035,” Dudley said.