The latest IEA report shows employment in the global energy sector expanding twice as fast as the rate for the overall economy, even as skilled labour bottlenecks pose rising risks

The latest IEA report shows employment in the global energy sector expanding twice as fast as the rate for the overall economy, even as skilled labour bottlenecks pose rising risks

trong investment in energy infrastructure drove a 2.2% rise in energy jobs last year, nearly double the rate of employment growth for the wider global economy, according to a new IEA report, which highlights the dynamic trends across the sector as well as bottlenecks for skilled labour in key areas.

The World Energy Employment 2025 report released today finds that global energy sector employment reached 76 million people worldwide in 2024, up more than 5 million from 2019. The sector has contributed 2.4% of all net jobs created across the global economy over the past five years.

The power sector is leading the way on job creation, accounting for three-quarters of recent employment growth, and is now the largest employer in energy, overtaking fuel supply. Solar PV is a key driver of growth, complemented by rapid expansions in hiring in nuclear power, grids and storage. Increasing electrification of other sectors of the economy is also reshaping employment trends, with jobs in EV manufacturing and batteries surging by nearly 800 000 in 2024.

Fossil fuel employment remained resilient in 2024. Coal jobs rebounded in India, China and Indonesia, pushing employment in the coal industry 8% above its 2019 levels despite steep declines in advanced economies. The oil and gas industry has also regained most of the jobs lost in 2020, although low prices and economic uncertainties have triggered job cuts in 2025. Based on early data, energy employment growth is expected to moderate to 1.3% in 2025, reflecting persistently tight labour markets and heightened trade and geopolitical tensions that are making some firms more cautious about hiring.

Despite the strong recent performance of the overall energy sector, the report warns of deepening skilled labour shortages. Out of 700 energy-related companies, unions and training institutions participating in the IEA’s Energy Employment Survey, more than half of them reported critical hiring bottlenecks that threaten to slow the building of energy infrastructure, delay projects and raise system costs.

Applied technical roles such as electricians, pipefitters, line workers, plant operators and nuclear engineers are in especially short supply. These occupations alone have added 2.5 million positions since 2019 and now represent over half of the entire global energy workforce, more than double their share of total employment in the broader economy.

An ageing workforce is intensifying the pressure, with 2.4 energy workers in advanced economies nearing retirement for every new entrant under 25. Nuclear- and grid-related professions face some of the steepest demographic challenges, with retirements outnumbering new entrants by ratios of 1.7 and 1.4 to 1 respectively.

At the same time, the supply of newly qualified workers is not keeping pace with the sector’s needs. To prevent the skills gap from widening further by 2030, the number of new qualified entrants into the energy sector globally would need to rise by 40%. The report shows that this would require an additional $2.6 billion per year of investment globally, representing less than 0.1% of spending on education worldwide.

Report’s chapter on energy efficiency

The following is an excerpt from the report:

Energy efficiency employment remained stable as investment momentum faltered in 2024

Global energy efficiency progress stabilised in 2024, as primary Industry efficiency employment levelled off at 3.6 million, mostly due energy intensity, a metric used to assess efficiency, improved by 1%, to a slowdown in China, which accounts for the largest share of the consistent with 2023 levels. Efficiency-related investment is set to sector’s workforce. A pronounced decline was seen in the European reach nearly USD 800 billion in 2025, up 6% y-o-y, but public support Union, where the limited availability of skilled labour posed a major schemes have decreased amid budgetary constraints. Energy

investment challenge for firms. Nevertheless, the Asia Pacific region efficiency employment climbed by 1.9% to 14.3 million in 2024. Most (outside of China) continued to boost employment in the sector.

workers are concentrated in China, the European Union and North America, but year-on-year job growth was fastest in emerging markets and developing economies like India (9%), Africa (4%) and other Asia Pacific (4%), all outpacing the global average.

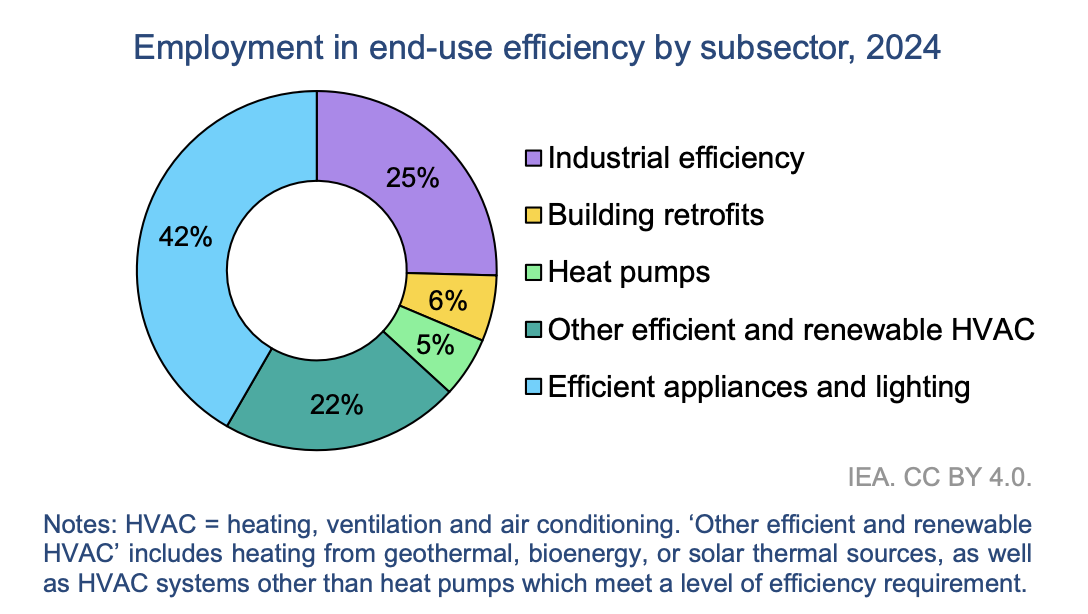

Building energy efficiency employment reached 10.6 million in 2024, covering a range of subsectors. Efficient appliances and lighting represent the largest share at nearly 6 million jobs, followed by heat pumps and other efficient and renewable HVAC equipment, which together account for nearly 3.9 million workers. The buildings sector includes around 850 000 working in retrofitting activities.

Governments continue to adopt energy efficiency policies for buildings, which remain a catalyst for employment. Major initiatives include the launch of the Indonesian National Roadmap for Green Building Implementation, and the Indian Energy and Sustainable Building Code. However, jobs in renewable HVAC systems remain below pre-pandemic levels as investments in the sector have declined, rooted in high upfront costs and tight investment budgets.

Industry efficiency employment levelled off at 3.6 million, mostly due energy intensity, a metric used to assess efficiency, improved by 1%, to a slowdown in China, which accounts for the largest share of the consistent with 2023 levels. Efficiency-related investment is set to sector’s workforce. A pronounced decline was seen in the European reach nearly USD 800 billion in 2025, up 6% y-o-y, but public support Union, where the limited availability of skilled labour posed a major schemes have decreased amid budgetary constraints. Energy investment challenge for firms. Nevertheless, the Asia Pacific region efficiency employment climbed by 1.9% to 14.3 million in 2024. Most (outside of China) continued to boost employment in the sector.

The future demand for energy efficiency workers is largely influenced by policies. In the CPS, the energy efficiency workforce would slightly decline in the coming decade to 13.3 million, while in the STEPS and the NZE Scenario, it would continue to expand, to reach 16.3 million and 22.4 million workers, respectively.

The full report is available here.

External link