The European Investment Bank’s Investment Survey is conducted annually and includes data from approximately 13 000 firms in all EU Member States plus a sample from the United States. The survey provides information on firm characteristics and performance, past investment activities and future plans, sources of finance and the financing issues businesses face. Below is a short overview and then a discussion on the findings related to climate change and energy efficiency.

The European Investment Bank’s Investment Survey is conducted annually and includes data from approximately 13 000 firms in all EU Member States plus a sample from the United States. The survey provides information on firm characteristics and performance, past investment activities and future plans, sources of finance and the financing issues businesses face. Below is a short overview and then a discussion on the findings related to climate change and energy efficiency.

Key takeaways

Investment growth is waning

Businesses are finding it difficult to plan. They are trying to understand the ultimate effect of US tariffs and potentially profound geopolitical changes. Those pressures could have depressed investment, but the EIB Investment Survey for 2025 finds that investment is showing remarkable resilience so far – although companies are more cautious about the economic outlook and the political and regulatory environment.

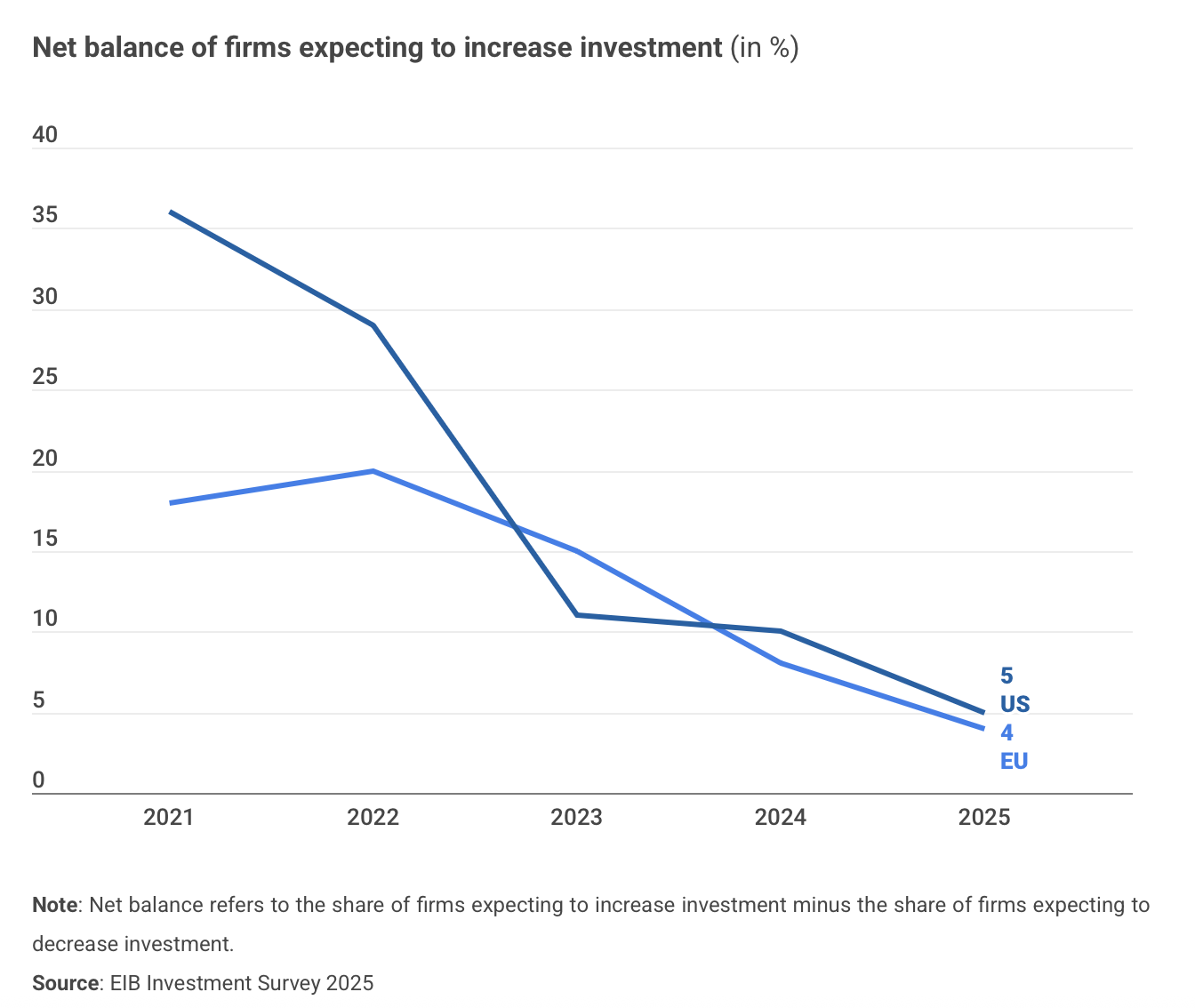

The European Investment Bank Investment Survey finds that 86% of EU firms still plan to invest, compared with 87% in the 2024 survey, although their appetite has somewhat weakened. A marginally higher share of EU firms still expects to increase rather than decrease investment in 2025, and investment growth is waning. The pattern in the United States is broadly similar.

Green transition: EU firms stay the course

EU firms appear more aware of the consequences of decarbonisation and the transition to green energy than their American counterparts. When considering transition risks, firms in Eastern Europe and some Central European countries are particularly aware of the associated risks, while firms in Northern Europe are more attuned to the opportunities.

- 36% of EU firms view the transition to stricter climate standards and regulations as a risk over the next five years, compared with 27% of US firms.

- 27% of EU firms see the transition as an opportunity, compared to 23% of US ones.

- Large firms are more likely than small and medium firms to view the transition as both a risk and an opportunity.

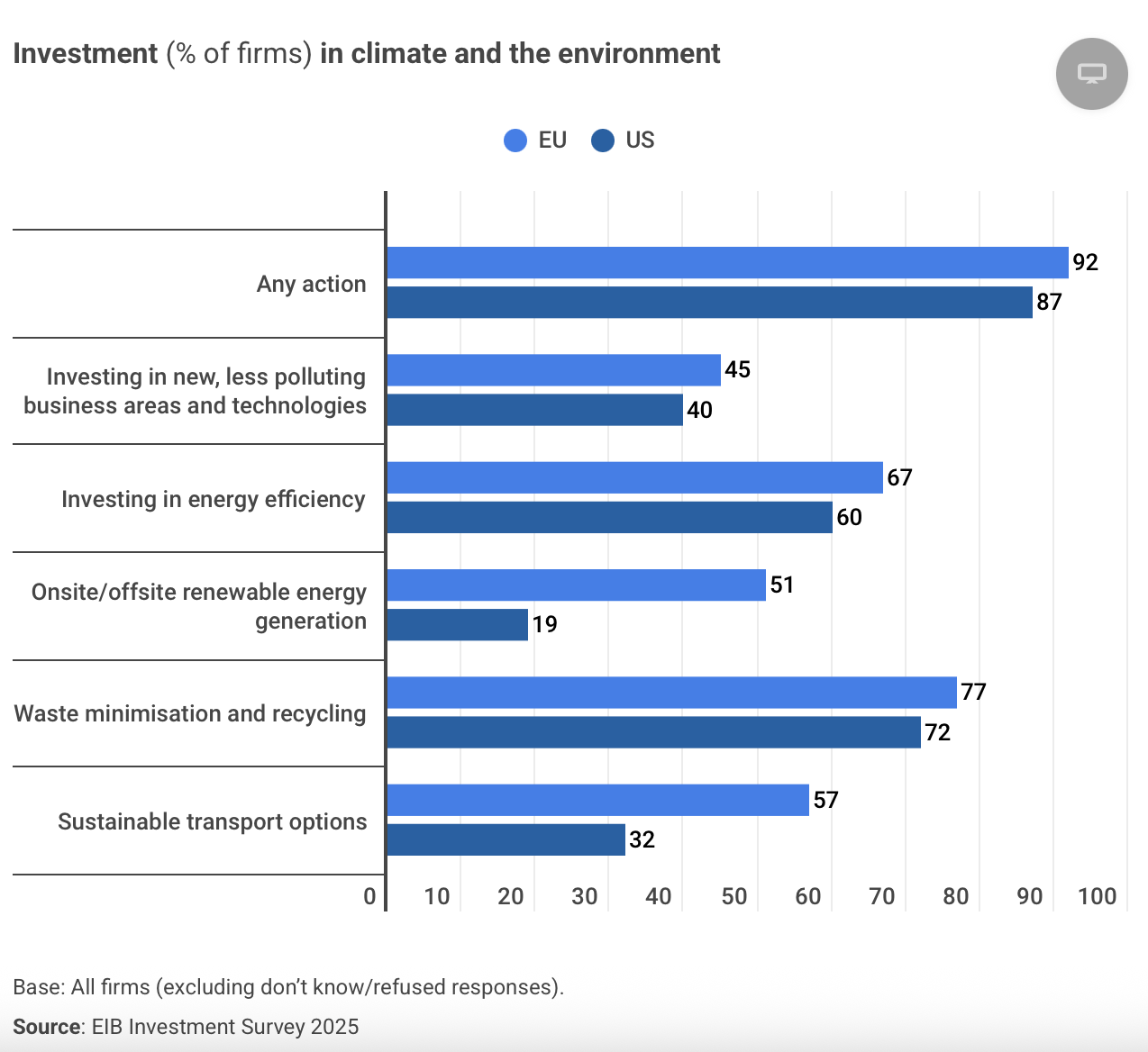

EU firms have been more proactive in reducing their greenhouse gas emissions. A higher share of them, 92%, have taken action to reduce those emissions. European firms are also more likely to invest in sustainable transport and renewable energy as well as other environmental measures, such as waste reduction and recycling.

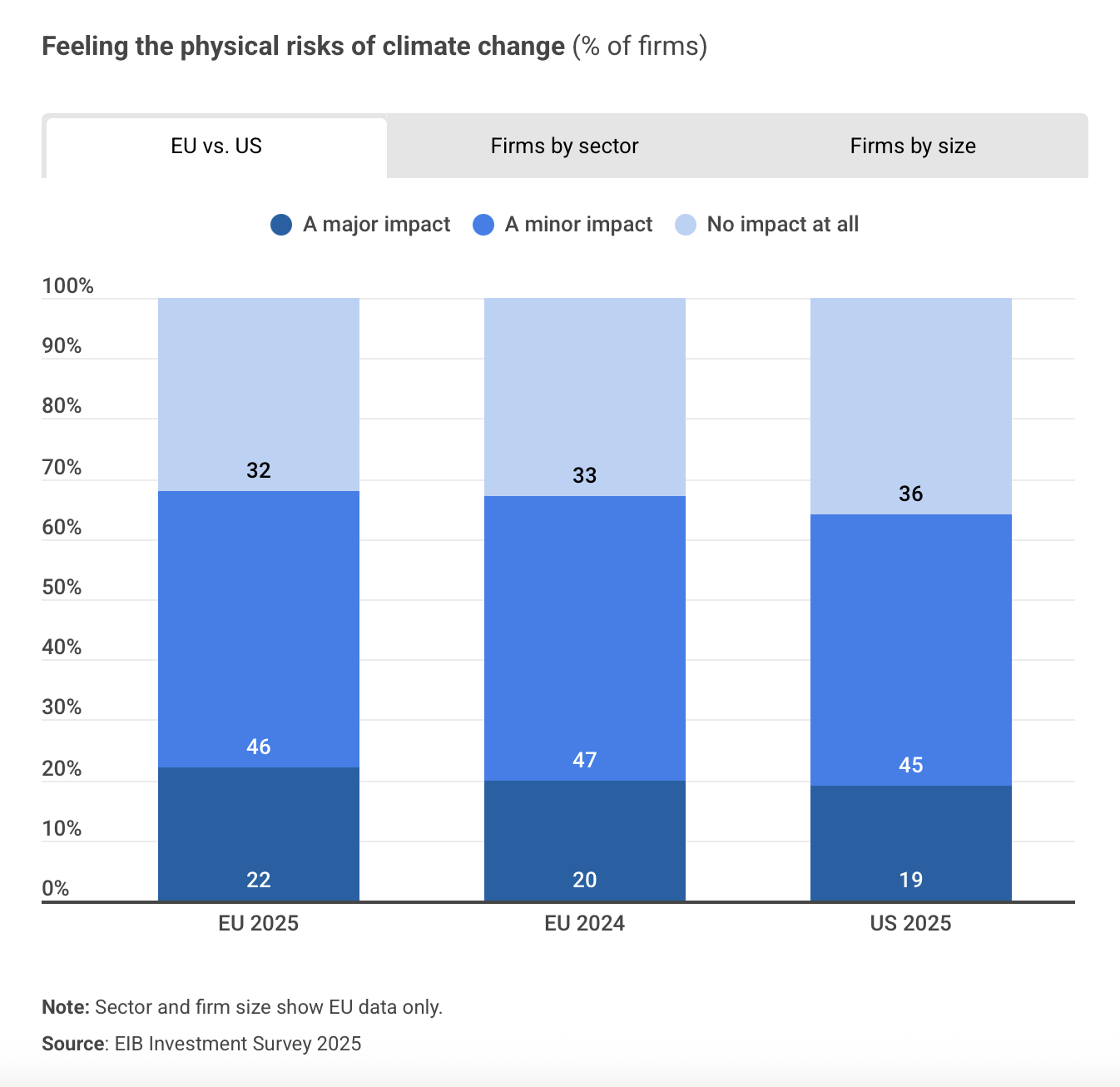

Overall, businesses are more aware of the physical risks associated with climate change and are slowly starting to act on climate adaptation. On both sides of the Atlantic, the share of firms faced with costs from extreme climate-related events is high: 68% in Europe, and 64% in the United States.

The share of firms acting to deal with physical risks has increased steadily and is relatively similar (55% in the United States vs. 53% in the European Union), however, US firms are more likely to have implemented adaptation strategies or investments. Investment in climate adaptation is generally on the rise.

Readers should refer to the report because there is an extensive section on climate change and energy efficiency.

The report is available here.

External link